Sample Language

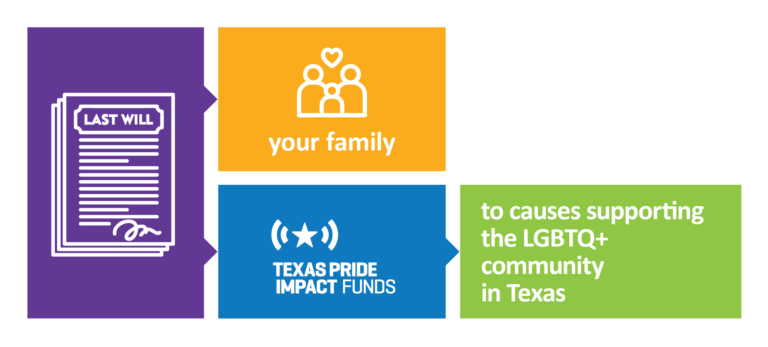

You can also leave TPIF an amount in you will or trust. You can designate a percentage, a specific amount (e.g., $10,000) or specific assets (e.g., a brokerage account, your home or other property). Alternatively, you can leave a contingent gift – that is a stated amount or percentage only if your spouse or other heir/beneficiary does not live longer than you. When making or revising a will or trust, donors should consult an attorney.

The following language may help you and your attorney when drawing up a Legacy Gift in your Will or Trust.

a. General Gifts in a Will

General gifts in a will are the most valuable, as they allow TPIF the flexibility to apply your gift wherever the need is the greatest. Examples of general bequests include:

- SPECIFIC GENERAL BEQUEST

“I give to Texas Pride Impact Funds, a Texas nonprofit corporation EIN #81-4143670, or its successor organization, the sum of $ _________ (or % of my estate), (or other personal property herein described) to be used for its general support and charitable purposes without restriction.”

- RESIDUARY GENERAL BEQUEST

“I give to Texas Pride Impact Funds, a Texas nonprofit corporation EIN #81-4143670 or its successor organization, (all or a % of) the residue of the property owned by me at death, real and personal and wherever situated to be used for its general support and charitable purposes without restriction.”

- “GREATER OF” RESIDUARY GENERAL BEQUEST

“I give to, Texas Pride Impact Funds, a Texas nonprofit corporation EIN #81-4143670 or its successor organization, the greater of _____ % of my estate or $_______ to be used for its general support and charitable purposes without restriction.”

b. Contingent Gifts in a Will

It is possible that the primary beneficiary or beneficiaries of your estate (such as your spouse or partner) may not outlive you. In such case, a contingent (alterative) bequest naming TPIF as a contingent beneficiary can provide a meaningful alternative.

“I give the residue of the property owned by me at my death, real and personal and wherever situate, to _____________________, if he/she survives me. If he/she does not survive me, I give to Texas Pride Impact Funds, a Texas nonprofit corporation EIN #81-4143670, or its successor organization, the residue of the property owned by me at death, real and personal and wherever situated to be used for its general support and charitable purposes without restriction.”

c. Bequest Restricted for a Specific Use

Some donors desire their gift to support a specific project, program or area (such as for gay youth or gay elders). Restricted gifts are welcome by TPIF. If you are interested in having your Legacy Gift support a specific project or program, it is best to discuss your plans with our staff before completing your bequest language to confirm your wishes can be met by TPIF.

“I give to Texas Pride Impact Funds, a Texas nonprofit corporation EIN #81-4143670, or its successor organization, the sum of $_________ (or % of my estate), (or other personal property herein described) to be used for (designated purpose*). If at any time it becomes impossible or impractical for my gift to be used for the above designated purpose, Texas Pride Impact Funds shall use my gift for a purpose and in a manner that it determines most closely meets the above designated purpose.”

Endowments at Texas Pride Impact Funds are invested in a diversified portfolio with the goal of providing long-term capital appreciation and current income, but positioned to safe guard against significant market swings during an economic downturn. The investment objective is to grow our endowed funds through investment returns by at least the rate of inflation.